An outlook on the New Zealand avocado industry

By Jen Scoular, August 2022

An outlook on the New Zealand avocado industry

- New Zealand has been forecasting a jump in volume as newly planted hectares come on stream

- Growers do need to be achieving higher production per hectare, and that will also increase the supply from New Zealand.

- NZ is unlikely to ever get to more than 2% of global supply

- The New Zealand industry has had a strategic objective to move more volume to Asia, and in 2021-22 it exported three times the volume to Asia than the previous year. Maintaining and growing market share takes investment in time and money

- There are 10 competing exporters in New Zealand. Each must decide on their strategy to reward their growers with good returns this year and in future years. Those strategies won’t all be the same

- The Australia market has provided a wonderful return for New Zealand growers for over five years. Investment is needed to achieve a premium over the more realistic “world price” exporters are likely to receive in Asia, and perhaps in Australia going forward. Any premium will depend on New Zealand ability to deliver premium avocados to a range of markets.

Rabobank recently issued a very informative report in setting out the current state and future outlook for the Australian avocado industry, with good commentary on the New Zealand industry. (Click here to access the Rabobank 2022 Australian & New Zealand Avocado Outlook media release and report). This is on the back of a very poor value year for both industries, caused by over supply in Australia, and a myriad of covid related disruptions across the supply chain.

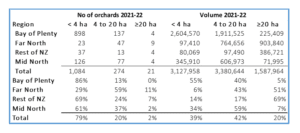

New Zealand growers have been very aware of the large new plantings in Northland, adding a forecast 1,000 hectares on top of the 4,000 hectares producing in 2018. These are large, intensively planted orchards as large as 250 hectares. We remain a sector of small to medium sized orchards, and even within those orchards there are as many growing avocados as a profession as growing avocados, as an additional income source, or growing avocados for other reasons. The diversity of the objectives of avocado growers is increasing.

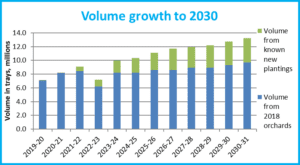

To model the impact of the new plantings, we look at the volume from hectares already planted in 2018, and add the volume forecast from hectares planted after 2018. This was presented at the 2021 AGM and is now updated with 2021-22 volumes.

With very variables yields across the industry, forecasting is certainly only that. The model looks at the volume coming from orchards across the three segments, best, good and standard. But history shows that even the best orchards have down years, and standard orchards have good years.

The crop estimate for 2022-23 indicates a lower production from older orchards, but has the higher volumes from new plantings starting to come onto the market.

The model suggests there will be an increase again in 2023-24, when the large orchards, with trees by then 4-6 years old, will be nearing full production. The model also assumes that new orchards will achieve 15-20 tonnes a hectare, although that hasn’t yet been proven to be achievable consistently with intensely planted orchards.

It is worth noting that the top grower in 2021-22 produced 59 tonnes per hectare (t/ha) on trees planted at the traditional 14m by 14m spacings, in the Bay of Plenty. Against the industry average of 11 t/ha, there is potentially a lot of upside yet to be achieved across New Zealand orchards.

The future destination for avocados from New Zealand

As the Rabobank report pointed out, New Zealand is way ahead of Australia in developing our export markets. NZ has been exporting to Japan and Australia for over 15 years, and has market access to all Asian markets except Vietnam. Gaining phytosanitary market access to China and India have been achieved in the last 5 years. The campaign to achieve market access to China took five years of investment from the industry, and maintaining that access requires on-going resource and attention. To gain access and then maintain it, the New Zealand industry must have robust systems to support the export of avocados. Those systems include recording of all chemicals used on orchards, a set of mandatory quality standards, strong phytosanitary discipline and a residue programme. New Zealand growers invest over $1million a year in those systems. Maintenance of market access is done in conjunction with the Ministry for Primary Industries. A summary of some market access activities is included in the appendix below.

When the Australian market crashed in 2021, New Zealand avocados had other export markets to go to, and our exporters moved more than three times as much volume to Asia in 2021-22 than the previous year. That was during a period where they could not travel to the market, and hadn’t visited customers for 18 months or more, freight was severely disrupted and demand was impacted with lack of food service during periods of lockdown in many countries.

The returns growers have enjoyed over the past 5 years came back sharply, but possibly to more expected forecast returns. With only 1½ % of the global avocado trade, New Zealand avocados will never dominate a market, but with smaller volumes exporters can find niche channels where premiums can be achieved by offering a premium quality avocado, delivered across a trusted supply chain. All avocados from New Zealand are able to leverage from our origin, our strong mandatory systems, and from the attributes of New Zealand avocados that come from a longer growing season and higher maturity. Achieving that premium requires quality of avocados to remain high, and the industry needs to keep investing in research to mitigate environmental issues that might otherwise impact on quality. The entire industry must deliver quality, to achieve premiums in market.

Demand from Asian countries is good, although avocados are still relatively unknown across many countries.

At the September 2021 virtual avocado congress, Fresh Intelligence Consulting’s Wayne Prowse said total consumption of avocados across Asia’s 3.6b population measures in at 0.21kg per person per annum. In contrast, European consumption comes in at 1.69kg per person per annum, while consumption in the US measures 3.70kg per person. Australian Avocados reported their consumption in 2021 at 4.7kg per person per year.

Investment in increasing, demand is important, there is excellent potential to increase demand, though let’s all recognise, that takes money and effort and time.

The benefits of hindsight

I am asked, shouldn’t the industry have expected this increase in Australian production? And the answer is that we did expect it. In 2015 I visited Western Australia and we heard from the growers that their production would start increasing exponentially in the next year. But it didn’t.

When growers rightly demand good or the best returns, exporters need to act to reward their growers but also must retain their growers. Growers can change their allegiance quite readily. If the return looks better across the fence, it’s a brave exporter who avoids the high values in Australia, to look after future returns. If their growers all change to another exporter, they lose the volume that they intended would achieve those future returns.

Appendix: Market access maintenance activity

Australia: Australia is New Zealand’s largest export market for avocados. The offshore pre-shipment inspection (OPI) programme has been replaced by the Compliance-Based Intervention Scheme (CBIS) which rewards and applies intervention rates based on importer–supplier compliance. The entire supply chain from orchard to postharvest are implementing measures to better manage avocado pests. However regular pest interceptions remain for egg and juvenile organisms where incomplete pest identification, results in precautionary actions being taken on potentially non-actionable pests.

China: New Zealand gained market access to China in January 2018. Trade to China is under an Official Assurance Programme (OAP) overseen by MPI, which requires annual grower, packer and exporter registration as well as pest monitoring and management in orchards and through post-harvest measures. Based on feedback from industry, NZ Avocado continue to seek improvements in the export programme to ensure practicality and its alignment with existing industry systems.

Thailand: In 2015 there was a trade agreement between MPI and Thailand which resulted in enhancements being made to the Thailand Importing Country Phytosanitary Requirements (ICPR). These sought to formalise pest measures at both the orchard and post-harvest level along with a requirement to submit grower and packer registers to Thailand.

Vietnam: Vietnam is seen as a potential new avocado market and MPI has been requested to pursue this. Vietnam will need to conduct a pest risk analysis (PRA) and several other commodity PRAs are already in progress by Vietnam, or in the queue.