March 2022

By Jen Scoular

No-one will say other than what a brutal year 2021-22 was across the New Zealand avocado season. The Australian market, until now always treated as the jewel in the crown completely over supplied itself with Australian volume in May creating a significant slump in value that it never recovered from. Pricing in Australia was down to $1 a piece at retail, prices not seen in 10 or 15 years. Huge volumes out of a number of Australian growing regions continued with nearly three times as much volume out of Western Australia as the previous year.

Supply from New Zealand growers was good. Volumes were at a similar level to the previous three seasons.

But there the good news stopped. Shipping was a nightmare for exporters. Timetables changed hourly, ships didn’t arrive, ships were delayed leaving, ships changed their routes as they were leaving. On top of which freight costs more than doubled to some destinations.

Considering the delays, the longer journeys the additional stops before final destination and some stoppages at the port because of covid illness of workers, quality issues were low. Which is great news, and perhaps a result of a very dry harvest period, particularly post flowering when quality issues run highest. Quality remains a huge challenge for the industry, I hope the quality project promoted by the Exporter Council gets off the ground in the year ahead, as an industry we need to invest to ensure we have a product that can compete, and compete strongly in all our markets. We will never compete well if our quality is other than excellent.

The impact of the well over-supplied, low returning Australian market opened the opportunity for much higher volumes going into Asia.

It has been a strategic objective under our Primary Growth Partnership to increase the percentage marketed in Asia and the season will see over 40% shipped to Asia, three times the volume shipped to Asia the previous season.

So if we are seeking out good news, we should report on the significant increase to Asia markets with season.

|

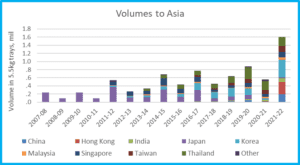

| Volumes to Asian markets from 2007 to the current season, in 5.5kg trays. |

Korea with 430,000 trays, Hong Kong with 302,000 trays and Thailand with 220,000 trays were the largest export markets, but volumes were shipped across nine markets. All credit to exporters building volumes to existing customers and finding new customers, despite not being able to travel to market.

No-one is hiding the fact that values returned from Asian markets to growers will be lower than in previous years, on top of significantly lower returns from Australia.

But looking ahead, exporters have confidence in the Asia markets for future volumes of fruit. They recently completed a five year plan for forecast volumes to 2026.

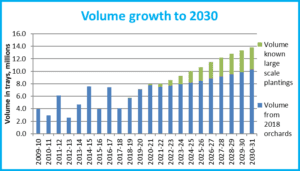

The forecast comes from an estimate of what current and new orchards will produce. There is a lot of talk about the new big plantings in Northland. Assuming they are well managed and produce good yields, the forecast for those volumes on top of existing orchards is charted below.

|

| The forecast volumes to be produced from both existing orchards and new plantings to 2030 |

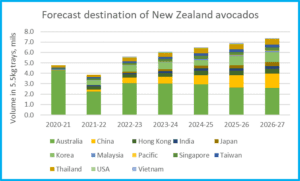

Based on this forecast we asked exporters to forecast the export destination of the volume they expect to handle.

Asia certainly has a pivotal role in the future of volumes, judging by the exporters five year plans.

In 2020-21 only 21% of exports were shipped to Asia, with the remainder going to Australia. By 2026 exporters are forecasting that volumes to Asia will grow from 555k in 2020-21, through 1.5m in 2021-22 up to 4 million in 2026.

Those markets won’t successfully grow without premium quality avocados being presented to the market. The quality is not yet strong enough, the whole industry needs to continue to invest to ensure we keep and grow the customers in all markets. The significant increase in volume being shipped to Asian markets will also require strong market development from both the industry and exporters to ensure demand matches that supply.

|

| The increasing volume expected of exports from New Zealand and the forecast market destination |

The New Zealand market has seen record supply, with large volumes diverted to New Zealand from export markets due mostly to freight issues.

Values were lower than previous years, so consumers should have been very happy, with an abundant supply, often of export quality.

New Zealand marketers were of the view that with the large volume, the upside is that new consumers will be introduced to avocados, and hopefully that makes them more likely to eat avocados now and into the future. Marketing spend was targeted to help move the volume through retail and ensure the quality of avocados available wasn’t negatively impacted by fruit hanging around too long. NZ Avocado works closely with NZ marketers to target the periods when supply is highest, and collects and reports data on the forecasted supply for the 6 weeks ahead.

Supply into the NZ market remains high, at nearly twice the volumes suppled a year ago, at this time of year. The marketing is intended to ensure consumers continue to be enticed to add an avocado dish to many of their meals through this wonderful long hot summer.

As an industry we are rightly feeling weary and perhaps despondent after the season we have had. But the opportunity ahead remains strong. Avocados remain a wonderful health product that is delicious, photogenic and able to be used at every meal. Consumption in Asia on a per capita basis is still very low, and education is required for consumers on how and why they should eat more avocados, especially avocados from New Zealand. Customers also need support on implementing the supply chain requirements to handle avocados from New Zealand.

I strongly believe that the best way to meet our industry vision to optimise returns for growers over the long term is to work together, debate hard, but collectively agree on the pathway forward, and share ideas, data and outcomes to improve both the pathway and the delivery back to growers.